Our DNA: active management and fundamental approach by availing of the market inefficiencies to obtain positive returns.

Our DNA: active management and fundamental approach by availing of the market inefficiencies to obtain positive returns.

Maximizing returns and beating the benchmarks. The investment in CIIs is subject to market fluctuations and other risks entailed by investing in financial instruments. Therefore, the net asset value and returns obtained may vary both upwards and downwards and thus, an investor may not recover the amount originally invested. Pursuing to beat the benchmarks does not entail achieving it.

01 Identifying companies

Assessment of the robustness of the business and the competitive position of the company.

02 Qualitative Analysis

Analysis of the consistency of the management team through one-to-one meetings.

03 Fundamental Assessment

Analysis of profitability expectations.

04 Client Experience

Client Perception.

05 Building up a Portfolio

Portfolio optimization.

Protection and optimization of heritage

1st Limit the variability of net asset value in very negative market environments.

2nd Maximize profitability. Investment in CIIs is subject to market fluctuations and other risks inherent in investment in financial instruments, so the net asset value and returns obtained may vary both upwards and downwards and an investor may not recover the amount initially invested.

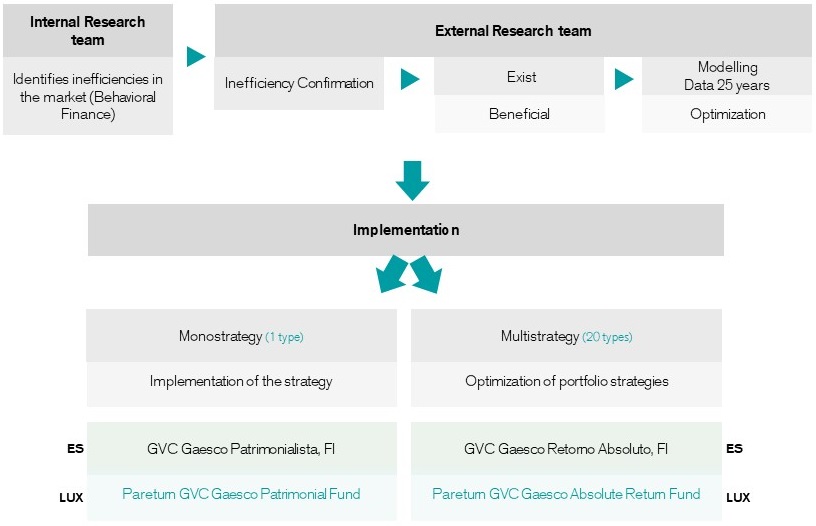

Based on Behavioral Finance. The typology of market inefficiencies is detected and exploited:

Quantitative approach: R+D

Attractive returns (in terms of revenue and investment growth) throughout the business cycle. Investment in CIIs is subject to market fluctuations and other risks inherent in investment in financial instruments, so the net asset value and returns obtained may vary both upwards and downwards and an investor may not recover the amount initially invested.

1. Analysis of the Macro Situation and the Economic Cycle

2. Sectoral and Geographical Choice

3. Exposure to interest and credit rates.

4. Análisis Bottom-up analysis

5. Portfolio construction

Legal notice. A complete report of each Investment Fund is available on the website with information concerning, among others, historical returns obtained prior to a substantial change in the investment policy of the IIC, series of annualized historical returns, detail of the risks associated with the investment in IIC, etc. Investment funds involve certain risks (market, credit, liquidity, currency, interest rate, etc.), detailed all of them in the Prospectus and in the Key Investor Information (KII) document. The nature and scope of the risks will depend on the type and particular features of the fund, the currency, and the assets in which the equity is invested. Consequently, the choice among different types of funds should be made considering the return expectations and investment time horizon as well as the willingness and ability to take risks of the investor.

The information contained on the website is for information purposes only and does not constitute an offer of products and services, nor a recommendation or offer to buy or sell securities or any other investment product, nor a contractual component. Nor does it imply legal, fiscal, or other advice and its content should not serve the user to make decisions or make investments. Investment funds can be high-risk products, not suitable for all clients. Therefore, they do not intend to persuade the user to inappropriate operations by making services or access available to operations and markets that do not match to the user’s risk profile. Past performance is no guarantee of future results. Taxation of yields obtained by unitholders shall depend on the tax legislation applicable to their personal situation and may vary in the future.